The role of the financial auditor in discovering errors and accounting manipulation

The financial auditor is an essential component of any organization’s financial system, playing a vital role in ensuring the accuracy and reliability of financial information This document aims to highlight the importance of the financial auditor in discovering accounting errors and manipulation, and how this affects transparency and accountability in institutions .

The importance of the financial auditor

The financial auditor is considered a watchful eye on financial operations, as he reviews financial records and ensures their compliance with approved accounting standards. Auditors help identify unintentional errors and intentional manipulations, which enhances the credibility of financial reporting.

Error detection

There are many types of errors that can occur in financial records, whether they result from omissions or accounting errors. The financial auditor uses multiple techniques, such as statistical analysis and field review, to discover these errors. Through these processes, auditors can identify areas that need correction and improvement.

Accounting manipulation

Accounting manipulation is a process that involves illegally or unethically altering financial information for personal gain. This could include inflating revenues, reducing expenses, or hiding debts. The financial auditor applies strict procedures to detect these practices, such as reviewing financial documents and verifying the validity of transactions.

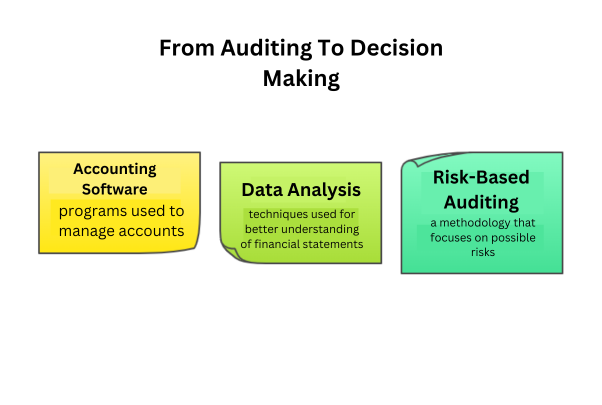

Financial auditor tools and techniques

Financial auditors use a range of modern tools and techniques to enhance the effectiveness of their operations. These tools include accounting software, data analysis techniques, and risk-based auditing. These tools help speed up the review process and increase its accuracy.

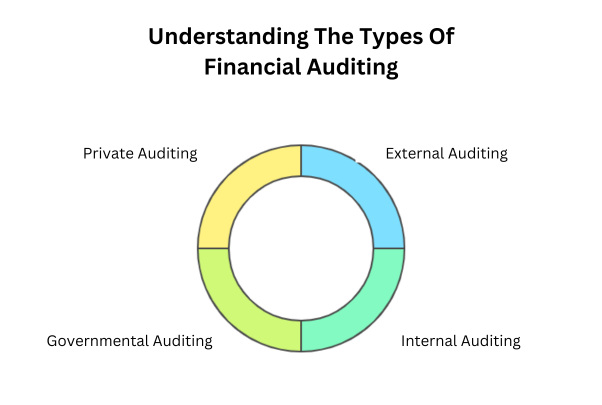

Types of financial audits which one is right for your organization?

The financial audit process is considered one of the essential elements that contribute to enhancing transparency and credibility in institutions. This document discusses the different types of financial audit, helping you determine which type is best suited for your organization based on its needs and goals. We will review the main types of financial auditing, explaining the advantages of each type and how to apply it.

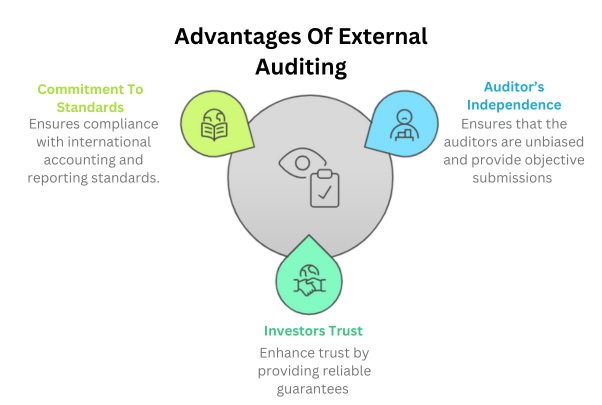

1_External audit

External auditing is performed by an entity independent of the organization, such as major auditing firms. This type of audit aims to evaluate the organization’s financial statements and ensure that they reflect the true financial situation. External auditing is essential for organizations seeking to attract investors or obtain loans, as it provides a high level of confidence for investors.

Advantages of external audit:

1_ Independence of the auditor.

2_ Enhancing investor confidence.

3_ Commitment to international accounting standards.

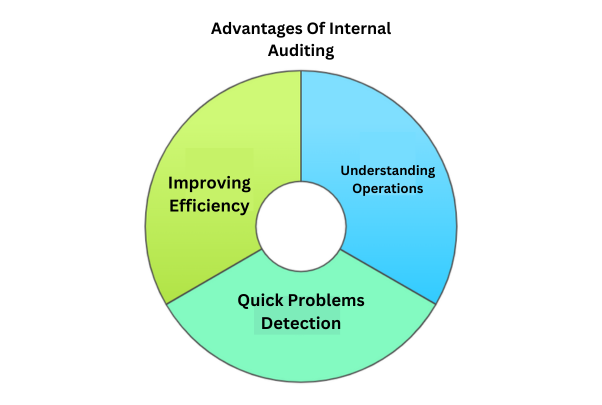

2_Internal audit

Internal audit is performed by employees within the organization and aims to evaluate the effectiveness of internal operations and financial control. This type of audit helps identify risks and improve the overall performance of the organization.

Features of internal audit:

1_ A deep understanding of the organization’s operations.

2_ Ability to identify internal problems quickly.

3_ Improve efficiency and effectiveness.

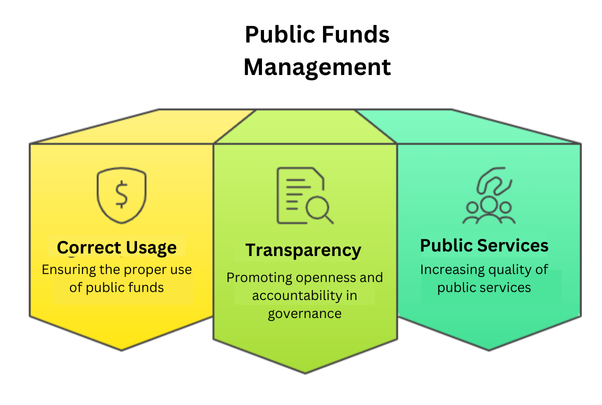

3_Government audit

Government audit is carried out by government bodies and aims to ensure that public funds are used correctly and efficiently. This type of audit includes reviewing the financial accounts of government agencies and public institutions.

Advantages of government auditing:

1_ Ensure that public funds are used properly.

2_ Enhancing transparency and accountability.

3_ Improving public services.

4_Private audit

A private audit is carried out at the request of a specific party, such as shareholders or creditors. This type of audit focuses on specific aspects of financial or operational processes.

Advantages of private auditing:

1_ Flexibility in determining the scope of the audit.

2_ Meeting the specific needs of the requesting party.

3_Possibility of focusing on specific areas such as compliance or risk.

see more:External Audit Procedures and Cash Account Examination

Choosing the appropriate type of financial audit for your organization depends on several factors, including the size of the organization, the nature of operations, and specific needs. It is important to evaluate each type of audit and understand its advantages and disadvantages before making a decision. By choosing the right type, you can enhance transparency and credibility in your organization, contributing to success and sustainable growth.