Preparation of Financial Statements for Companies

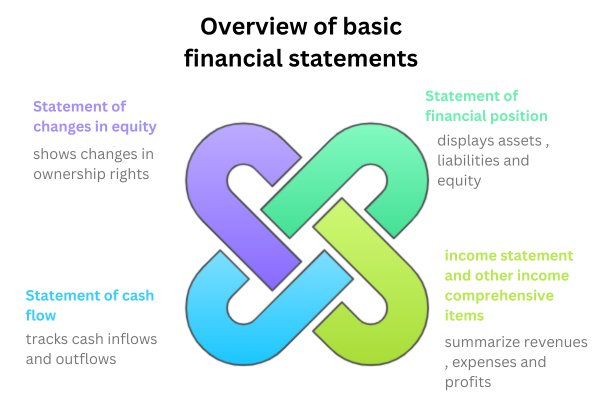

Financial statements are essential tools for presenting a company’s financial performance, providing accurate information that aids in financial decision-making. These statements include the balance sheet, income statement, cash flow statement, and statement of changes in equity. This document aims to explain how these statements are prepared and their importance in evaluating financial performance and making investment decisions.

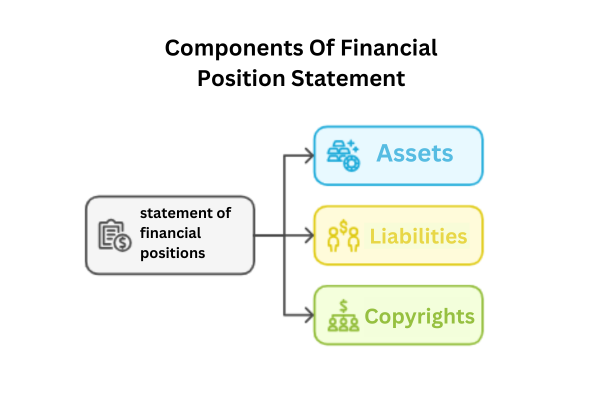

Balance Sheet

The balance sheet (also known as the statement of financial position) reflects a company’s financial status at a specific point in time. It consists of three main components:

Assets: Includes current assets such as cash, accounts receivable, and inventory, as well as non-current assets like real estate, equipment, and intangible assets.

Liabilities: Includes current liabilities such as accounts payable and short-term debt, and non-current liabilities such as long-term loans.

Equity: Represents shareholders’ investments in the company, including paid-in capital and retained earnings.

Income Statement

The income statement presents revenues and expenses over a specific financial period, helping determine net profit or loss. It consists of:

Revenues: All sales and other sources of income.

Expenses: Includes operating costs, administrative expenses, and other costs.

Net profit or loss: Calculated by subtracting expenses from revenues.

Steps to Prepare an Income Statement:

- Identify the financial period for which the statement is being prepared.

- Collect revenue and expense data.

- Calculate net profit or loss.

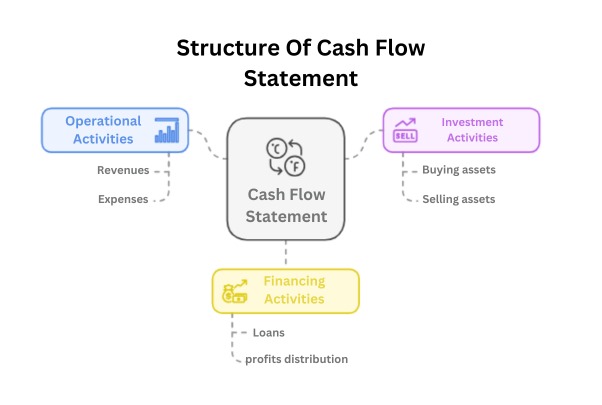

Cash Flow Statement

The cash flow statement tracks the movement of cash in and out of a company over a specific financial period. It is divided into:

Operating cash flows: Cash generated from daily business activities.

Investing cash flows: Funds used for purchasing or selling fixed assets and investments.

Financing cash flows: Related to loans, dividend payments, and capital increases.

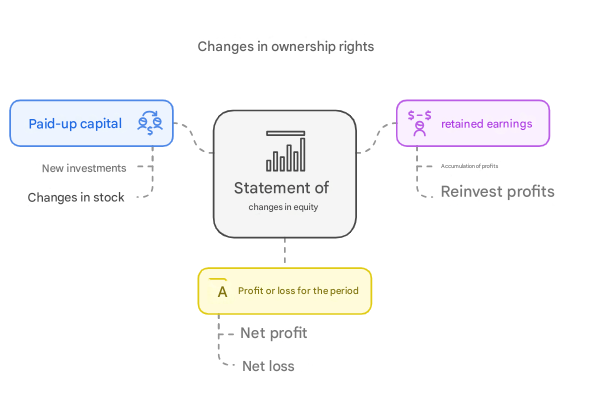

Statement of Changes in Equity

The statement of changes in equity outlines modifications in shareholders’ equity over a specific period, including:

Paid-in capital: Changes in shareholders’ investments.

Retained earnings: Profits not distributed as dividends.

Net profit or loss: As reported in the income statement.

Steps for Preparing Financial Statements

- Gather financial data from accounting records and prepare a trial balance after adjustments.

- Verify account balances and ensure opening and closing balances are accurate.

- Prepare financial disclosures and compile data from the trial balance.

- Prepare the income statement and other comprehensive income items.

- Prepare the statement of changes in equity.

- Prepare the balance sheet.

- Prepare the cash flow statement.

Conclusion

The preparation of financial statements is a fundamental step in assessing a company’s financial position. These statements provide accurate information that helps investors and management make well-informed financial decisions. By analyzing the balance sheet, income statement, cash flow statement, and statement of changes in equity, companies can improve their financial performance and enhance their sustainability in the market.